The Befouled Weakly News

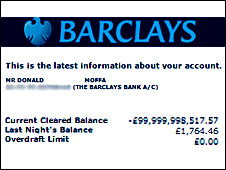

11 January 2009 Whew! It is cold, cold, cold! Nothing, I guess, compared to what those of you on the East coast are used to experiencing but for us, in the alleged shelter of the Gulf Stream, it is cold! Over this past week the night time temperature has been hovering down around -10 Celsius (apparently, about 14 degrees Fahrenheit) and the daytime highs have been all the way up to the balmy heights of zero. In addition to the (for us) Arctic conditions, we’ve had thick fog over the past couple of days so that the frost has decorated the trees and shrubs with a bright white icing. The garden pond has been frozen for the past week much to the consternation and annoyance of the neighbourhood wood pigeons and other local wildlife who are consistently perplexed by their inability to get a drink out of what after all does resemble a pond. AND, Ms Playchute is demanding that the radiator in the bedroom be turned on! I guess it's cold. After the excessive enjoyments of the Christmas break, this week has been a model of decorum and modesty. What a relief it is to get back to work! (Just kidding, don’t worry). Ms Playchute and I have made our picks for this weekend’s football matches. I’ve not yet watched the recording of last night’s games so don’t tell me the score! Last week her only winning selection was the Cardinals over the Falcons but her rational is flawless – last week she wanted to ensure that she a collection of different entities so she had a bird (Cardinals), a horse (Colts), a person (Vikings) and a fish (Dolphins). To be fair, she had to stretch the last one because, as we know, a dolphin is not actually a fish but it was close enough for her. This week she has the Eagles (a bird), the Titans (a mythological deity), the Chargers (what the heck are they – a lightening bolt?) and the Cardinals (again). I have the opposite so we’ll see. I know we’re all having to cope with the fallout from the current financial crisis but how would you like to have been on the receiving end of a letter from your bank informing you that you were just short of 100 billion pounds overdrawn as in the following:

Still, it could be worst. I ran across the following from a couple of years ago as a link from the story above:

Perhaps we’ve discovered the causes of the credit crunch! Banks haven’t actually lost all this money, they just keep putting it all in the wrong places. Love to you all, Greg I recently picked a new primary care doctor. After two visits and exhaustive lab tests, he said I was doing "fairly well" for my age. A little concerned about that comment, I couldn't resist asking him, "Do you think I'll live to be 80?" He asked, "Do you smoke tobacco, or drink beer or wine?" "Oh no," I replied. "I'm not doing drugs, either!" Then he asked, "Do you eat rib-eye steaks and barbecued ribs?" I said, "No, my former doctor said that all red meat is very unhealthy!" "Do you spend a lot of time in the sun, like playing golf, sailing, hiking, or bicycling?" "No, I don't," I said. He asked, "Do you gamble, drive fast cars, or have a lot of sex?" "No," I said. "I don't do any of those things." He looked at me and said, "Then, why the hell do you want to live another 20 years?" On their wedding night, the young bride approached her new husband and asked for $20 for their lovemaking encounter. Her husband readily agreed. It set a precedent -- this scenario was repeated each time they made love for more than 40 years, with him thinking that it was a cute way for her to afford new clothes and other incidentals that she needed. Arriving home around noon one day, she was surprised to find her husband sitting at the kitchen table, head in his hands. During the next few minutes, he explained that with the economy shattered, General Motors had laid him off from his well-paid management position. It was unlikely that, at the age of 59, he'd be able to find another position that paid anywhere near what he'd been earning, and because he had counted on his pension, he never invested any money and they were financially ruined. Calmly, his wife handed him a bank book which showed more than 40 years of steady deposits and interest -- the total nearly $1 million. The husband was starting to get rather excited, but then she showed him certificates of deposits issued by the bank which were worth over $2 million, and informed him that they were one of the largest depositors in the local bank. She explained that for the more than three decades she had "charged" him for sex, these holdings had multiplied and these were the results of her careful savings. Faced with evidence of cash and investments worth over $3 million, her husband was so astounded he could barely speak, but finally he found his voice and blurted out, "If I'd had any idea what you were doing, I would have given you all my business!" They found him submerged in Lake Erie, in his favorite Chevy. Some men just don't know when to keep their mouths shut. And, along a similar theme.... As a painless way to save money, a young couple arranged that every time they have sex the husband puts his pocket change into a china piggy bank on the bedside table. One night while being unusually athletic, he accidentally knocked the piggy bank onto the floor where it smashes. To his surprise, among the masses of coins, there are handfuls of five and ten dollar bills. He asks his wife "What's up with all the bills?" To which his wife replies, "Well, not everyone is as cheap as you are."

|